😇 The Secrets to Angel Investing

Hey Builders,

Feeling low from that market crash? Don't sweat it. As long as you have enough savings for Chipotle this week, you're in the clear. That'll give you enough runway to spin up a Kernal MVP and make 10X your losses back. If you did happen to pull out of the stocks at the right time and are looking to put your money to good use, the Super Bowl is eyeing up a few more 30-sec ad partners and the going rate is $6.5m. Reply to this email if you want an intro. 🏈

Today's menu is a feast: 🍽

- Angel investing gems by Lenny Rachitsky

- Fresh startup ideas to pounce on

- Top reads of the week

Fill up your french press and let's get to it. ☕️

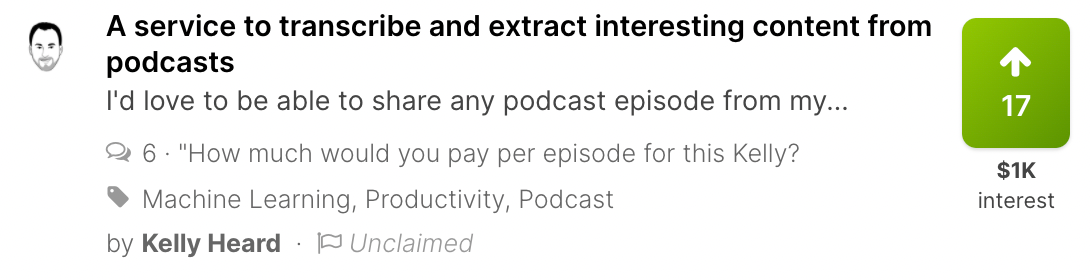

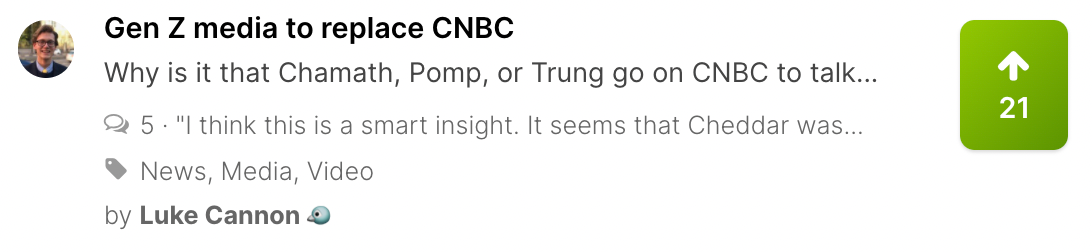

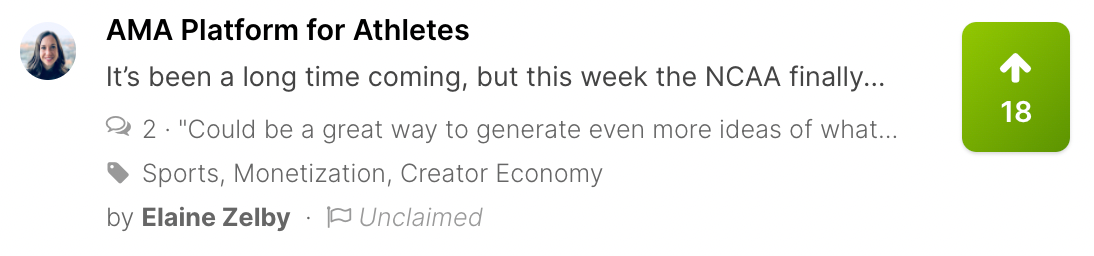

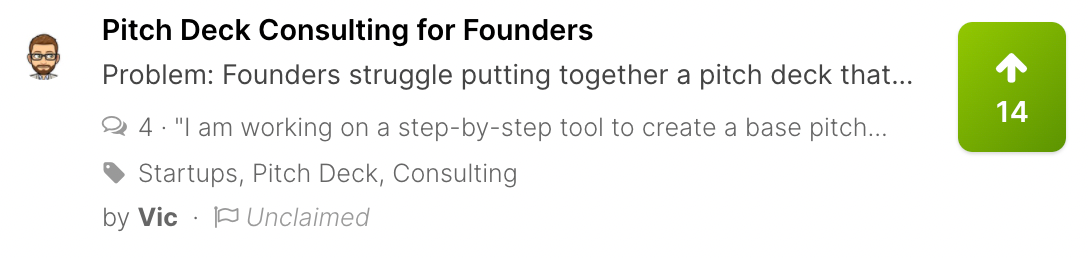

🌱 Startup Ideas of the Week

📝 3 Lessons from 140+ Angel Investments

With all this stock market mayhem, my eyes lit up when I saw a ray of hope in my inbox last night. What's that I asked? 👀

It was a newsletter from Lenny Rachitsky. The subject line? Lessons from 140+ angel investments. Turned out to be jam-packed with goodies. So, out of pure curiosity (and no slimy affiliate commission), I wanted to curate some of his top insights for Kernal members to run with. Let's roll. ✨

Why you should trust Lenny: In 5 years, he's invested in 140 startups (brands above) and AngelList claimed he was one of their top solo investors. 12 of his investments have become unicorns and 10 are on schedule to unicorn this year. 🦄99% chance he knows what he's talking about.

Tip 1: The best investments usually don't start as "great calls"

- Every deal Lenny ranks his confidence level by writing OK, Good or Great

- When he looked back on his 140 deals, only 30% of them were marked Great

- If he only invested when he felt Great, he'd miss out on 70% of his portfolio

TL;DR: "If you see something special about the startup, and there’s a path to a 100x exit, consider investing even if you don’t have full conviction." - Lenny

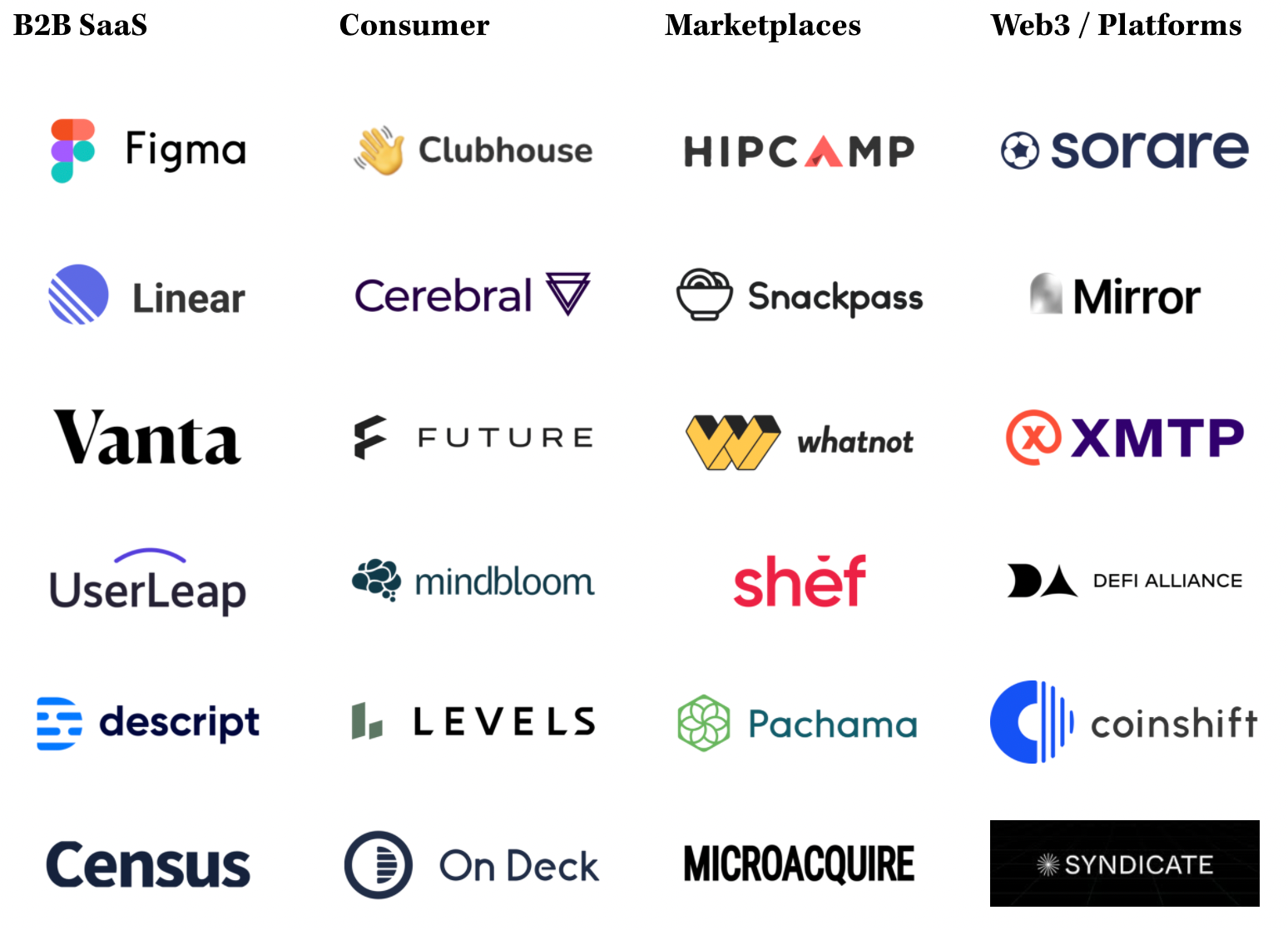

Tip 2: Most deal flow comes from other investors

- 50%+ of Lenny's deals come from other investors,

- ~25% come from his own outreach and

- ~25% come inbound (cold emails from Kernal users 😏 )

TL;DR: To have killer deal flow, buddy up with active investors

Tip 3: Be someone founders want on their cap table

- Best way to grow deal access is being someone founders want on their cap table

- Do this by having a skill founders like (distribution, growth, intros etc)

- Build a newsletter, scale a podcast, be value-add focused every way possible

That's it for the breakdown. Hope it was helpful at painting a picture of the angel investing world. As a founder, operator or investor, I think reviewing these notes every once in a while can serve as good reminders.

If you want the full article from Lenny dig in here. Liked the summary? Reply to the email to let us know. 👋

*Full discolusre*: I'm in no way related to Lenny or any of his angel investments though my future kids' college fund wish I was.

👩💻 Top Reads of the Week

- ☀️ Andrew Huberman's Morning Routine, backed by Neuroscience (Dan)

- 🛥 Shaan Puri's POV on if the Bored Ape Yacht Club is worth $5B

- 📓 Dickie's free guide for writing on the internet (I read it and it was fire)

- 💸 Key lessons from 140+ angel investments (Lenny)

- 🤔 Deep-dive on the future of blockchains and offline assets (Eric)

- 📲 The $9B market that’s expected to grow 30% in 7yrs? Podcasting. (William)

🔦 Meme of the Week:

Lituidity with another winner:

Wanna join our Discord waitlist? Click below to ask our team.

Wanna be featured in next week's newsletter? Send us what you're working on.

Have a great weekend friendos.

💚 Kernal fam

How did you like this week's newsletter?

😍 Loved it · 😕 Meh · 😠 Hated it